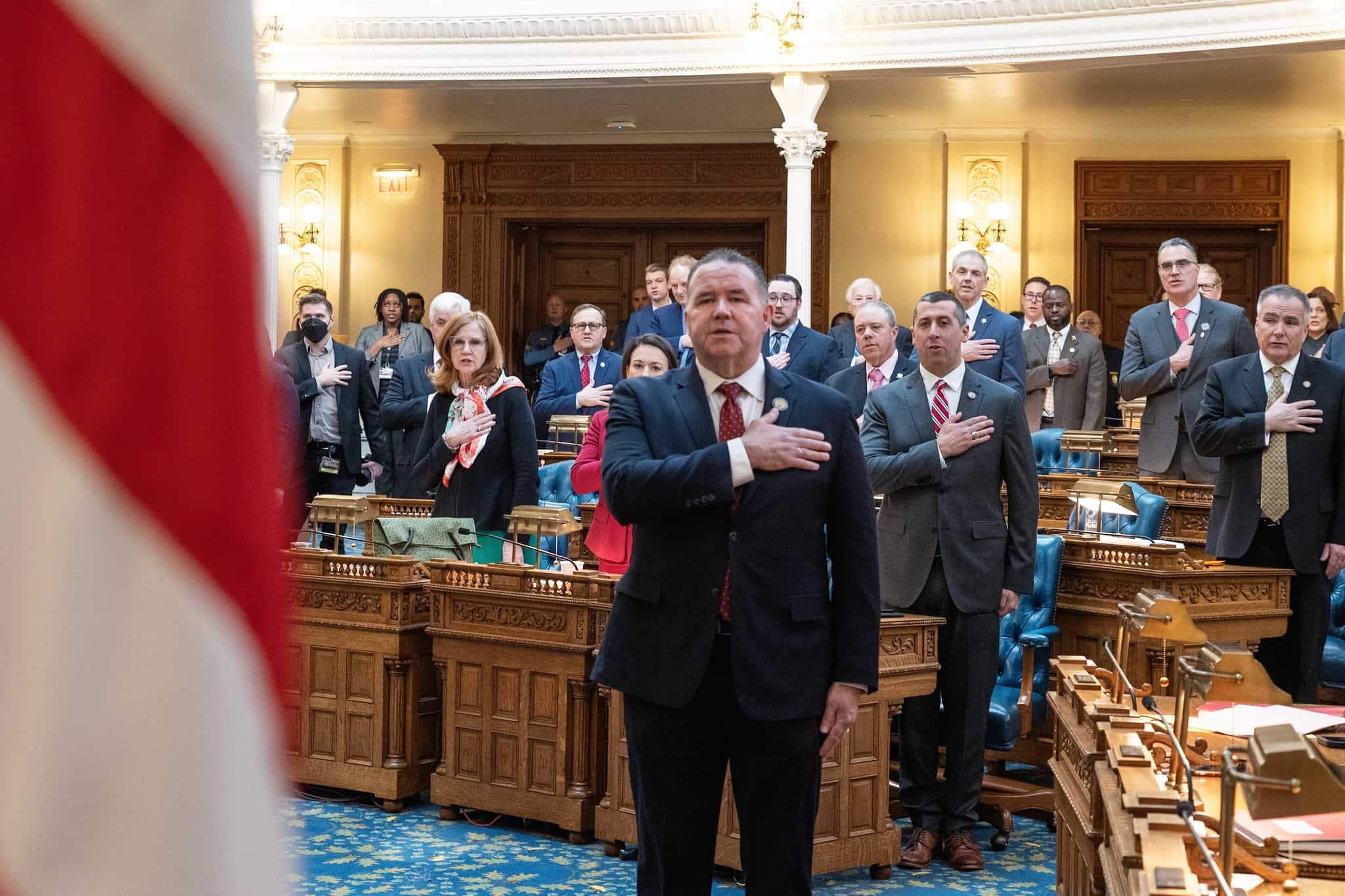

By Assemblyman Alex Sauickie

This month has yielded both bad news and good news for homeowners. The bad news is due to government action. The good news comes from a court striking down another government action. Perhaps there’s a lesson here.

First, the bad news. If you’re a homeowner seeking to refinance your mortgage, or more likely in these times, a person seeking to buy a home, the federal government has decided to impose a penalty on you if you’ve maintained good credit, or saved enough for a relatively big down-payment.

Of course, that’s not how the Federal Housing Finance Agency would describe its new rule, scheduled to go into effect on May 1. Its director, Sandra Thompson, says the purpose is to “increase pricing support for purchase borrowers limited by income or wealth” by imposing “minimal” fees.

Borrowers with a good credit score, of about 680 or 740 based on different reports, will pay around $40 more each month on a $400,000 mortgage. Amounts raised by the new fees will be used to subsidize the mortgages of people with lower credit ratings and less money for a down-payment, through fee discounts.

While that may sound to some like a nice thing to do, it has broader negative market implications. I’ve made it clear that I’m in favor of improving housing affordability, having heard compelling instances of working people being priced out of their homes due to big rent increases and seeing the fast-rising interest rates affecting homebuyers. New Jersey’s ever-high property taxes don’t help, either.

The implications are that the new rule both devalues good credit and savings, and places others in greater jeopardy of obtaining a mort[1]gage they ultimately can’t afford. Let’s all just think for a moment about whether there’s relatively recent experience with approving lots of mortgages for risky borrowers. Remember the term “sub-prime”?

This isn’t a political or partisan point of view. David Stevens, who served as Assistant Secretary of Housing and as Federal Housing Commissioner in the Obama administration, said this approach “won’t work and more importantly couldn’t come at a worse time for an industry struggling to get back on its feet.” He also said, “America is facing a severe shortage of affordable homes for sale combined with excessive demand causing an imbalance. But convoluting pricing and credit is not the way to solve this problem.”

Seems that the Federal Housing Finance Agency should go back to the drawing board and come up with a solution that works considering market conditions.

Also in need of a trip back to the drawing board–or even better, just giving up–are local governments trying to choke off the supply of natural gas to homeowners and renters who have or want gas-powered appliances. I’ve written before about the Murphy administration’s efforts to do that in New Jersey.

The U.S. Court of Appeals for the Ninth Circuit unanimously ruled that Berkeley, California’s ban on gas piping in new building construction violates federal law, the Energy Policy and Conservation Act (EPCA) of 1975.

Judge Patick Bumatay wrote the court’s opinion that said, in part, that Berkeley “enacted a building code that prohibits natural gas piping into those buildings, rendering the gas appliances useless.” He concluded, “In sum, Berkeley can’t bypass [federal] preemption by banning natural gas piping within buildings rather than banning natural gas products themselves.”

Berkeley was the first city to ban gas connections in most new homes and buildings. Since then, at least 50 California cities, including San Francisco and Sacramento, have adopted similar rules. Meanwhile, during this push for more electrification, California leads the country in rolling blackouts in recent years and has had the most outages in the nation this year, leaving residents inconvenienced and often in the dark. Cities such as New York and more in other states have also adopted similar policies.

At least 20 states, including Arizona, Georgia, Florida, Ohio and Texas, have passed laws banning their cities from restricting gas use.

While this ruling was a win for home[1]owners and renters who want the freedom to choose energy-efficient gas appliances, both the Biden and Murphy administrations are continuing to pursue policies with intent similar to Berkeley’s. Stay tuned.

# # #

Alex Sauickie is a life-long Jackson resident who represents his home town and 13 other towns in the State Assembly.